Making insurance more accessible to vulnerable people

As the world leader in creditor insurance, BNP Paribas Cardif’s mission is to make insurance more accessible. In France, for several years the insurer has been supporting medical research to take into account the latest advances in treatment and offer the best insurance conditions to people suffering from illnesses such as gestational diabetes, asthma and Parkinson’s disease. BNP Paribas Cardif is now extending this approach to individuals affected by chronic inflammatory bowel disease (IBD) - including Crohn’s disease - of whom there are more than 270,000 in the country(3).

30 years

BNP Paribas and Adie (“Association pour le droit à l’initiative économique” - Association for the right to economic initiative) have a partnership dating back 30 years which aims to develop microloans in France. While celebrating the exceptional longevity of this collaboration (see page 64), the two partners sealed a new three-year commitment.

A new fund accelerating the development of impact bonds

In 2019, BNP Paribas launched the first fund dedicated to investing in impact bonds in the European Union, notably in France. The impact bond is a unique financial partnership involving the public and private sectors and the social and solidarity economy (SSE), intended to develop positive solutions for society or the environment, and focusing on prevention, innovation and the systemic transformation of public policies.

On the strength of its contribution to the work that led to the recommendations of the Cazenave report(4), the Group is launching its second edition: the BNP Paribas European Impact Bonds Fund 2. The project was initiated by the team responsible for impact bonds at the Group’s Positive Impact Business Accelerator, in association with BNP Paribas Asset Management, which manages the fund. Three strategic investors have already signed up alongside BNP Paribas: Banque des Territoires, the European Investment Fund (EIF) and BNP Paribas Cardif.

With a target size of €70 million, this fund aims to accelerate the development of the impact bond market in the European Union. Notably, it will fund projects on themes such as the professional inclusion of young people in precarious situations (scholarship holders, refugees, people from priority urban neighbourhoods), the circular economy, the employment of people with disabilities and the fight against food waste. As of 31 December 2023, the new fund had already financed nine projects.

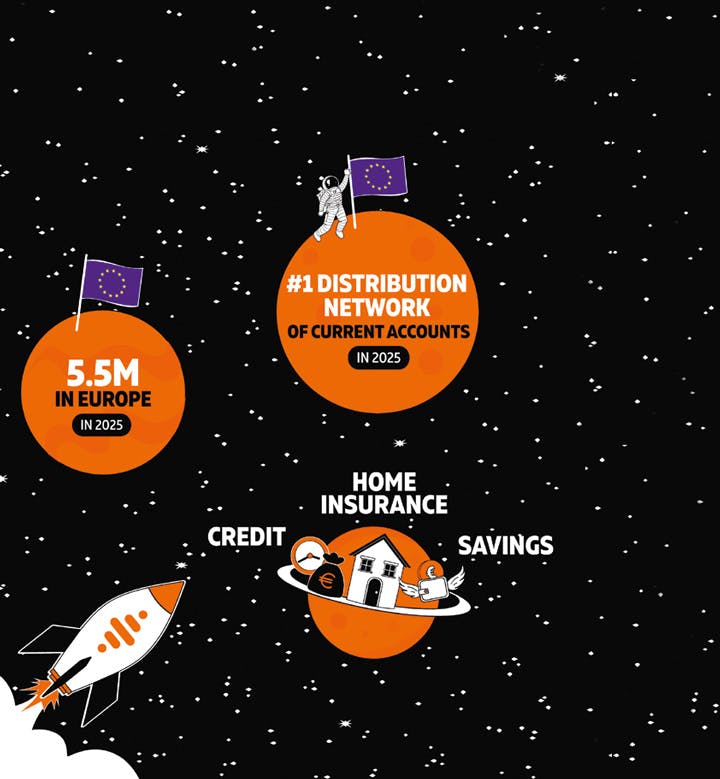

Nickel accelerates its development

Launched in 2014, Nickel, the leading current account distribution network in France now relies on more than 10,000 points of sale to serve its nearly 3.7 million customers across all its locations. Through its expansion in Spain, Belgium, Portugal and Germany, Nickel is targeting 5.5 million customers in Europe, and aims to become the leading current account distribution network in the region by the end of 2025. The company has remained true to its initial promise of being accessible to all, regardless of income. The fintech is also diversifying its services, offering a credit package in partnership with FLOA and a home insurance package for tenants with BNP Paribas Cardif and the insurtech Lemonade. The next step: launching a savings offering.