BNP Paribas, the main distributor of the participatory recovery loan

In May 2021, the French State launched the participatory recovery loan (PPR - “prêt participatif relance“) to support the development of small and medium-sized enterprises (SMEs) and mid-caps, while enabling them to bolster their cash flow thanks to its four-year grace period. A long-standing partner of SMEs and mid-caps, BNP Paribas naturally mobilised its resources to roll out this scheme, available until the end of 2023. With a total amount of €2.3 billion in PPR loans, the Group was the main distributor of this financing facility. In doing so, Commercial & Personal Banking in France has helped to speed up the digital transformation, the energy transition, the modernisation of production facilities and the development of new activities in France and abroad for many of its SME and mid-cap clients, who have benefited from the scheme.

An approach focusing on the needs of entrepreneurial families

The vast majority of businesses in Europe are family-owned - from 61% in the Netherlands to over 80% in Spain, Italy and France(1). They’re a key driver of economic growth, employment and social development. BNP Paribas Wealth Management provides these entrepreneurial families with support tailored to their needs. The business line puts its dedicated team of 300 people at their disposal. Drawing on BNP Paribas’ integrated model, it also facilitates their access to all the Group’s areas of expertise, notably those of Global Markets, BNP Paribas Asset Management and BNP Paribas Real Estate.

(1) Report on “The challenges of family governance in Europe and emerging trends”, BNP Paribas Wealth Management and SDA Bocconi School of Management, June 2023.

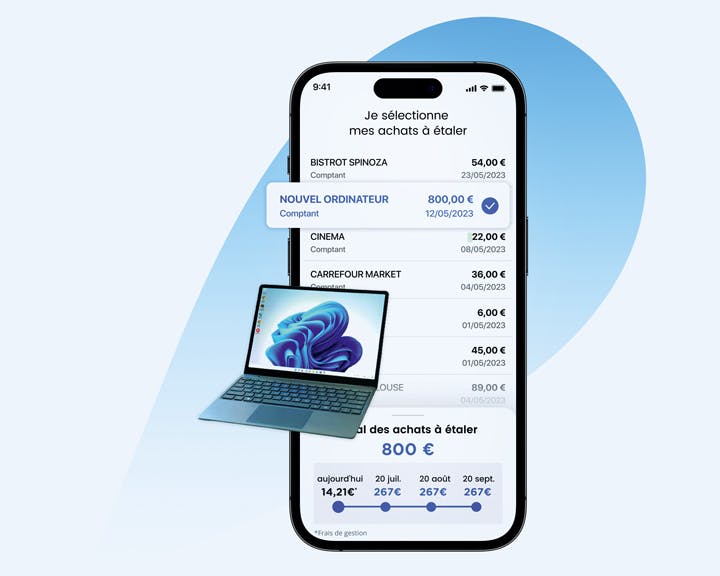

FLOA, the benchmark customer experience

Blending digital innovation and human support, the customer experience provided by FLOA, the French leader in payment facilities, was awarded the “CX Award by Contentsquare”, which identifies the best user experience initiatives on the market. FLOA also won the “Customer Service of the Year 2024” award for the fourth time in the “Credit institution” category, and, for the second time in a row, in the “Payment Solutions” category.

1,000

This is the number of new FLOA partners in Europe, accelerating its international development. Among them, the airline Iberia and Portugal’s leading price comparison site, KuantoKusta.