Accelerating our transformation at scale with challenges of our time

Our financial indicatorsOur financial indicators

Thanks to its financial solidity combined with the power of its diversified and integrated model, BNP Paribas achieved a very good performance in 2022, confirming the relevance of its GTS 2025 strategic plan. The ability to support our customers and the economy globally by mobilising our teams, resources and expertise continues to support the strong growth in business and results.

All three of our operating divisions contributed to the increase in our revenues of 9% compared to 2021. We also recorded a strong increase in net income Group share of 7.5% compared to 2021 (+19% excluding exceptional items). The robustness of our balance sheet is reflected in our CET1 ratio of 12.3%. We apply a shareholder return rate of 60% and also provided net earnings per share of €7.80 and a net dividend per share of €3.90. These last two indicators were up compared to 2021.

For more information on all of our financial indicators, see the 2022 Universal Registration Document on invest.bnpparibas

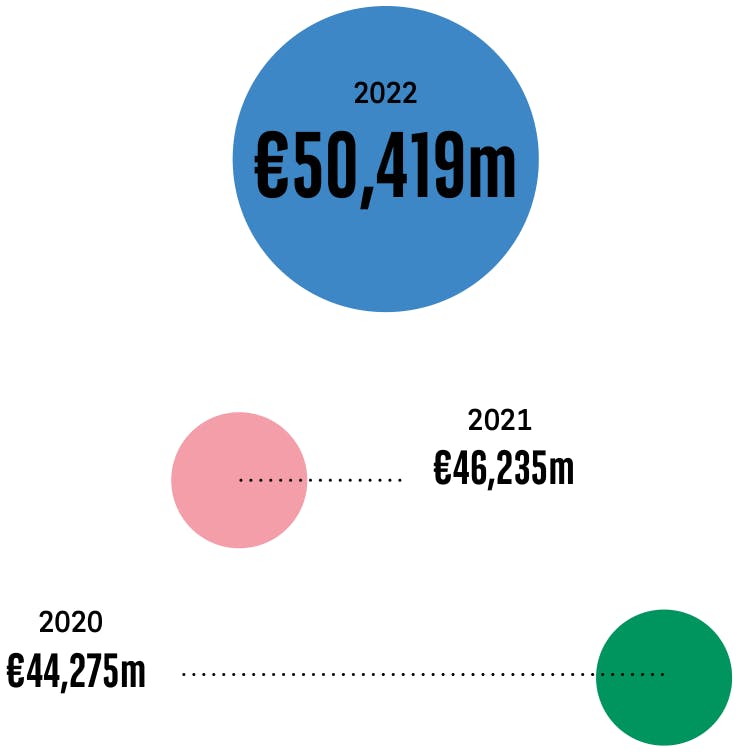

Group revenues

- 2022: €50,419m

- 2021: €46,235m

- 2020: €44,275m

Net income Group share

- 2022: €10,196m

- 2021: €9,488m

- 2020: €7,067m