Building a collective dynamic

Nurturing the relationship with our shareholders and investorsNurturing the relationship with our shareholders and investors

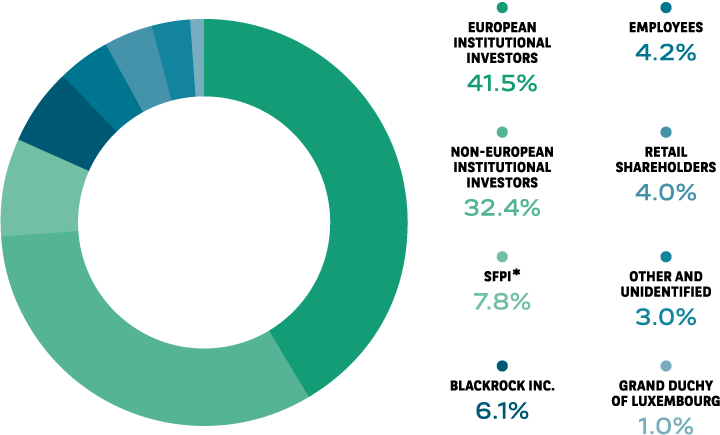

A SHAREHOLDER BASE THAT STANDS OUT FOR ITS STABILITY AND LOYALTY

Shareholding structure at 31 December 2021 (in % of voting rights).

SHAREHOLDER DASHBOARD

| In euros | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Earning per share(1) | Earning per share (1)20176.05 |

Earning per share (1)20185.73 |

Earning per share (1)20196.21 |

Earning per share (1)20205.31 |

Earning per share (1)20217.26 |

| Net book value per share(2) | Net book value per share (2)201775.1 |

Net book value per share (2)201874.7(*) |

Net book value per share (2)201979.0 |

Net book value per share (2)202082.3 |

Net book value per share (2)202188.0 |

| Net dividend per share | Net dividend per share 20173.02 |

Net dividend per share 20183.02 |

Net dividend per share 20190.0(3) |

Net dividend per share 20202.66(4) |

Net dividend per share 20213.67(6) |

| Pay‑out ratio cash(7) | Pay‑out ratio cash (7)201750.0 |

Pay‑out ratio cash (7)201852.72 |

Pay‑out ratio cash (7)20190.0(3) |

Pay‑out ratio cash (7)202050.00(5) |

Pay‑out ratio cash (7)202150.00(6) |

| Share price | Share price2017

|

Share price2018

|

Share price2019

|

Share price2020

|

Share price2021 |

| Highest(8) | Highest (8)201768.89 |

Highest (8)201868.66 |

Highest (8)201953.81 |

Highest (8)202054.22 |

Highest (8)202162.55 |

| Lowest(8) | Lowest (8)201754.68 |

Lowest (8)201838.18 |

Lowest (8)201938.14 |

Lowest (8)202024.51 |

Lowest (8)202139.71 |

| Year‑end | Year‑end 201762.25 |

Year‑end 201839.475 |

Year‑end 201952.83 |

Year‑end 202043.105 |

Year‑end 202160.77 |

| CAC 40 index on 31 December | CAC 40 index on 31 December 20175,312.56 |

CAC 40 index on 31 December 20184,730.69 |

CAC 40 index on 31 December 20195,978.06 |

CAC 40 index on 31 December 20205,551.41 |

CAC 40 index on 31 December 20217,153 |

- Based on the average number of shares outstanding during the fiscal year.

- Before distribution. Revaluated net book value based on the number of shares outstanding at year‑end.

- Following ECB/2020/19 recommendation of the European Central Bank of 27 March 2020 on dividend distribution policies during the Covid‑19 pandemic, the distribution of €3.10 per share initially proposed to the Annual General Meeting of 19 May 2020, was appropriated to “Other reserves”.

- €1.11 distributed following the approval of the Shareholders’ Combined General Meeting of 18 May 2021, plus €1.55 distributed following approval by the Ordinary General Meeting of 24 September 2021; taking into account only the distribution of the 2020 dividend.

- Taking into account only the distribution of the 2020 dividend.

- Subject to approval at the Annual General Meeting on 17 May 2022, taking into account only the distribution of the 2021 dividend and not taking into account the share buyback programme of €900m, carried out between 1 November 2021 and 6 December 2021.

- Dividend distribution recommended at the Annual General Meeting expressed as a percentage of net income attributable to shareholders.

- Recorded during the meeting.

* Impact on shareholders’ equity at 1 January 2018 of the first application of IFRS 9: - €2.5bn, i.e. €2 per share.

How do we communicate with our shareholders?

BNP Paribas takes care to provide all its shareholders with rigorous, regular, consistent and high‑quality information.

The Group acts in accordance with the recommendations of the stock market authorities and best market practices. In this context, an “Investor Relations” team is responsible for informing institutional investors and financial analysts about the Company’s strategy, as well as significant developments and results, which are published each quarter.

What is the role of the Shareholder Liaison Committee

Created in 2000, the Shareholder Liaison Committee supports BNP Paribas in its communications aimed at individual shareholders. It meets several times a year and is made up of ten shareholders based on their geographical and socio‑professional representativeness, plus two current or former employees. Membership in the committee is for three years.

How is the shareholder community animated?

Created in 1995, the BNP Paribas Cercle des actionnaires (Shareholders’ Group) brings together the 46,000 shareholders holding at least 200 shares in the Group. Each semester, shareholders receive the financial information letter and the minutes from the Annual General Meeting.

Shareholders are regularly offered economic updates and online training sessions on stock market transactions (technical and financial analysis, portfolio diversification, etc.).

Since the beginning of the health crisis, the Cercle has enriched its offer of regular newsletters. It also launched Cercle podcasts and interviews with historians, speakers and artists, etc.